طبقة تشغيل

بالذكاء الاصطناعي

لمنشأتك

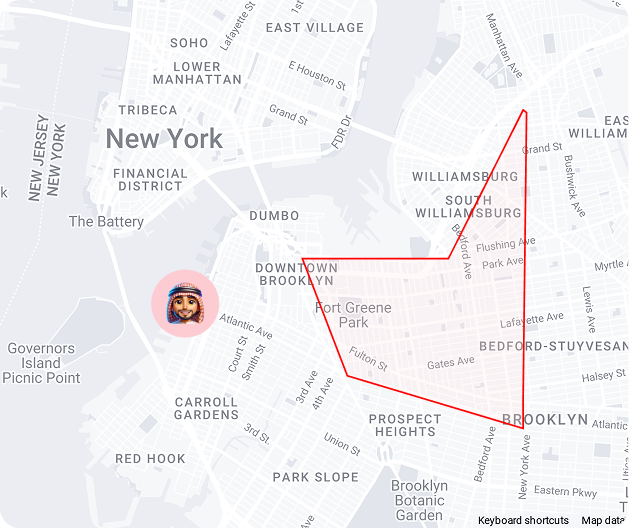

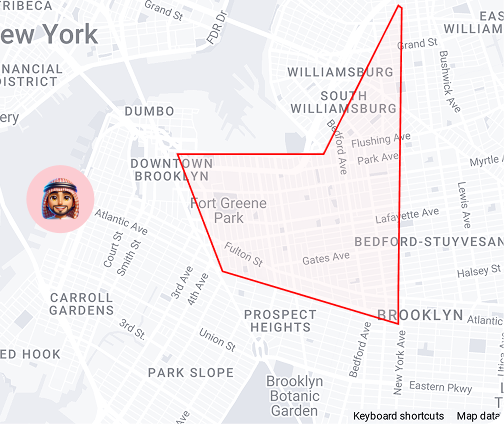

منصة تعتمد على الرؤية الحاسوبية وتحليل المشاعر وتتبع المواقع

لتحويل بيانات الواقع إلى قرارات تشغيلية دقيقة في الوقت الحقيقي.